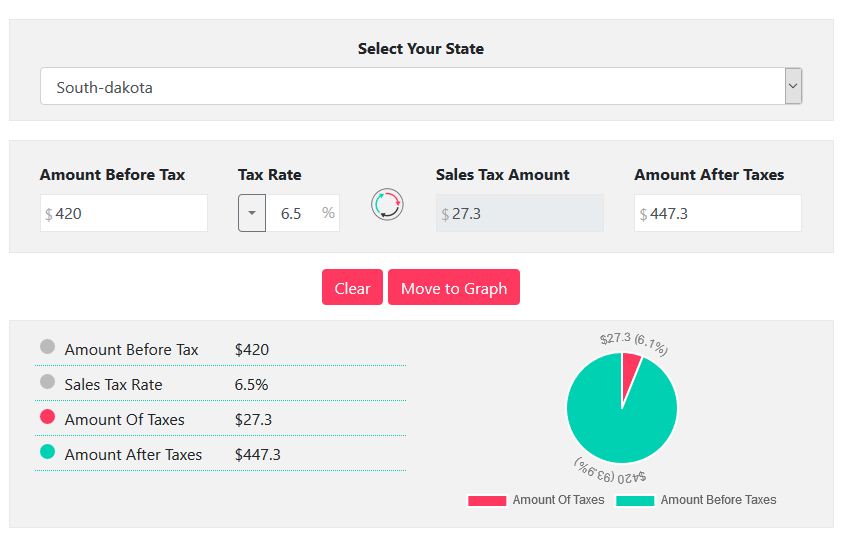

south dakota sales tax calculator

The average cumulative sales tax rate in Chamberlain South Dakota is 65. Your household income location filing status and number of personal exemptions.

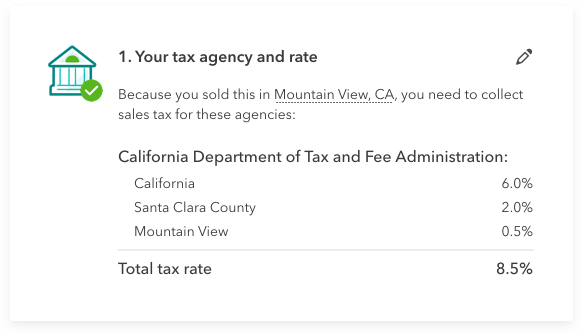

Understanding California S Sales Tax

The calculator will show you.

. South Dakota all you need is the simple calculator given above. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Just enter the five-digit.

South Dakota state sales tax rate range 45-65 Base state sales tax rate 45 Local rate range 0-2 Total rate range 45-65 Due to varying local sales tax rates we strongly. This includes the rates on the state county city and special levels. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

There also arent any local income taxes. Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city. South Dakota Sales Tax Calculator You can use our South Dakota Sales Tax Calculator to look up sales tax rates in South Dakota by address zip code.

With local taxes the total sales tax rate is between 4500 and 7500. Chamberlain is located within Brule County. This includes the rates on the state county city and special levels.

Free sales tax calculator tool to. South Dakota Sales Tax Calculator and Economy Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount. This includes the rates on the state county city and special levels.

This makes South Dakota a. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. Average DMV fees in South Dakota on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above.

One field heading that incorporates the term Date. Rate search goes back to 2005. Just enter the five-digit.

Find your South Dakota combined state and local tax rate. South Dakota municipalities may impose a municipal sales tax use tax and gross. As mentioned above South Dakota does not have a state income tax.

One field heading labeled Address2 used for additional address information. What Rates may Municipalities Impose. To know what the current sales tax rate applies in your state ie.

The South Dakota sales tax and use tax rates are 45. Vehicle Leases Rentals Tax Fact 1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases. The South Dakota sales tax rate is 45.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Wallace is located within Codington County. Should you collect sales tax on shipping charges in South.

South Dakota Documentation Fees. Enter the Amount you want to enquire about. The average cumulative sales tax rate in Wallace South Dakota is 45.

The average cumulative sales tax rate in Wood South Dakota is 45. South Dakota SD Sales Tax Rates by City The state sales tax rate in South Dakota is 4500. Wood is located within Mellette County South.

Free sales tax calculator tool to estimate total amounts.

Dmv Fees By State Usa Manual Car Registration Calculator

State Sales Tax Rates 2022 Avalara

Understanding California S Sales Tax

State Sales Tax And Corporate Income And Franchise Tax After Wayfair Wagner Tax Law

Economic Nexus And South Dakota V Wayfair Inc Avalara

Car Tax By State Usa Manual Car Sales Tax Calculator

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Sales Tax Software For Small Business Quickbooks

Should You Move To A State With No Income Tax Forbes Advisor

Llc Tax Calculator Definitive Small Business Tax Estimator

Sales Taxes In The United States Wikipedia

How To Calculate Cannabis Taxes At Your Dispensary

South Dakota Sales Tax Calculator Reverse Sales Dremployee

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With The Highest Lowest Tax Rates

Sales Tax South Dakota V Wayfair Cfgi

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation